Pushing the Boundaries: Health Insurance Considerations in the New World of Work-From-Anywhere

RISING HEALTHCARE CONCERNS FOR TRAVELERS

Percentage of travelers who agree that health concerns factor into their decision when choosing international travel destinations

Percentage of travelers who agree that they’re concerned about getting sick while traveling abroad; this increases to 65% for parents and Gen Z

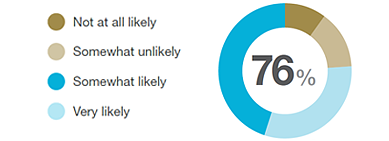

Percentage of people who think there is a possibility they’d need to use international travel medical insurance

Source: International Travel Medical Insurance: Awareness, Usage and Perceptions, Harris Poll & GeoBlue, December 2022.

Percentage of consumers likely to ensure they have medical coverage while traveling internationally

Percentage of travelers who agree that they’re concerned about getting sick while traveling abroad; this increases to 65% for parents and Gen Z

There has been a shift in those who have checked their coverage before traveling abroad; most of that increase (15%) was from consumers who planned to use their existing health plan.

Nearly 1 in 4 Americans have had medical issues while traveling abroad

Percentage of those who have had medical issues while traveling abroad that required care

For those Americans who have traveled internationally over the last 5 years, 4 in 10 have had medical issues

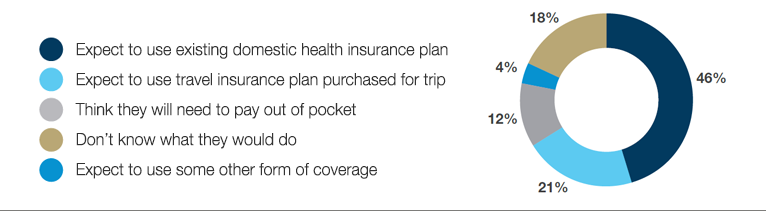

76% of consumers either don't know how they would pay for medical treatment abroad or likely won't have adequate coverage

With nearly half of consumers planning to rely on their domestic health plan while traveling abroad, it’s clear most people aren’t aware of the coverage gaps that could result in emotional and financial distress when using a domestic plan abroad.

Some domestic employer-sponsored health plans offer no coverage abroad.

Most ACA plans don’t provide international medical coverage.

Even the best Medicare supplement plans have limited international benefits.

Most employer-sponsored and ACA plans aren’t designed to be used abroad. With 190+ countries in the world, all with different healthcare systems and infrastructure, U.S.-style health plans often don’t work abroad.

| Care and Service Outside the U.S. | Consumer/Traveler Impact |

|---|---|

|

|

|

|

|

|

|

|

For more information on the need for health insurance while traveling abroad, see the following resources: